Investing in the Cooperative Economy

Food co-op members know how important it is to “source” a product. One of the main reasons many of our members choose to shop at the co-op is because they can be sure that co-op products contribute to a healthy and just economy. We will drive across town for food that is “fair”—but how many of us think of deploying our money that way?

Just as we know how important it is to examine the underlying system that brings us our food and to choose family farming over factory farming, so too should we examine the underlying system that stewards our money.

Do you know what your dollars are doing while they are tucked away in your bank account? Are they supporting organic farming, worker-owned cooperatives, affordable housing and retail food co-ops? Or are they supporting sweat shops, big business, slumlords, and polluters? How can you know?

How can we be sure that the money we have held in savings is supporting the same kind of world that our food co-op dollars are? By investing in cooperation of course!

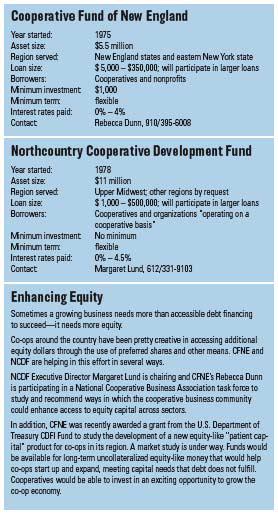

The Northcountry Cooperative Development Fund (NCDF) and the Cooperative Fund of New England (CFNE) are two community development loan funds that specialize in cooperatives, making it easy to direct your passive funds to actively shaping a better world.

NCDF is a co-op of co-ops representing 118 consumer, worker, producer and housing cooperatives across the upper Midwest. The Fund was started in 1978 by a group of Twin Cities area food and worker cooperatives that had trouble accessing the capital they needed from traditional banks.

Over the years, investments from co-ops have been a key part of NCDF’s capital structure, with many co-ops alternating between borrowing funds for their own growth and investing savings for other co-ops to use.

The Wedge Community Co-op in Minneapolis is typical of NCDF’s members: “The first loan we ever did with NCDF was an equipment loan in the late ’70s or early ’80s,” remembered longtime finance manager Elka Malkis, an NCDF board member. “As we started having some cash reserves, we started investing in NCDF. And then we began to be a bigger borrower.… When we did our first expansion in 1992, we had a history of being very busy, but not profitable—we knew we needed to expand to where we could take that busy-ness and turn it into profitability.”

Unable to land a loan right away from a traditional bank, The Wedge turned to NCDF for supplemental funding in its expansion project. “NCDF was the first lender to support the project that we proposed” said Malkis “and it was through its early support and vote of confidence that we were able to go to the bank and leverage additional funding.”

As its members envisioned, the Wedge expansion did lead to increased profits. Today, the Wedge is one of the most successful food co-ops in the country and is NCDF’s largest cooperative investor.

Smaller co-ops, too, understand the importance of investing in cooperation. Betsy Perkins, General Manager of Amazing Grains in Grand Forks, North Dakota, remembers that even before the great flood of 1997, the co-op had been an active supporter of its co-op loan fund. When the flood waters forced a move, the co-op had difficulty finding anyone to lend to them. “We tried getting loans from con- ventional banks” says Perkins. “Nobody would loan us the money—but NCDF did.” Now that the co-op is thriving again, it continues to invest in NCDF. “We invest to support the co-op community. It’s a main reason we put our money there,” says Perkins. “We wouldn’t be here without NCDF.”

The Cooperative Fund of New England (CFNE) was founded 30 years ago by representatives of producer and consumer cooperatives throughout the region. At the time, the purpose of the Fund was to provide desperately needed loan capital for food cooperatives and to provide an alternate investment option for individuals with investment resources.

Since then, CFNE has made a difference to more than 380 borrowers, with loans totaling more than $13 million. Borrowers include all types of cooperatives and worker-owned businesses. Some CFNE investors are cooperatives as well.

Tim Wingate, Chief Financial Officer at Hunger Mountain Food Co-op in Vermont, recalls its first CFNE loan for $125,000 in 1995, which helped it triple the size of their store. He says the move from CFNE borrower to investor was a natural. “We generate a lot of cash and were looking for ways to invest it. Now, it feels great to come full circle and send that check back to Co-op Fund of New England.

“It’s following the sixth co-op principle, cooperation among cooperatives,” he adds. “I think food co-ops understand that we’re undercapitalizing our future by not borrowing and making the improvements we need to make.”

The founders of Equal Exchange came from the region’s food co-op sector, where CFNE was active from its beginning. It was only natural to turn to mission-based CFNE for a loan as they launched this pioneering worker co-op, which has come to play a lead role in the global Fair Trade food movement. Most of EE’s loans were for inventory.

Co-founder Rink Dickinson explains: “The Fair Trade model is all about buying the farmers’ coffee when it’s available. It’s very capital intensive. It takes mountains of cash to buy mountains of coffee this way.”

The co-op’s sales have skyrocketed since then, and its ever-expanding product line now includes fairly traded teas, chocolate, and sugar. Rink emphasizes that were it not for CFNE, there might never have been an Equal Exchange. “From the beginning CFNE was a strong ally, and for many years they were one of the major sources of capital for us,” he says. “It’s what enabled us to do Fair Trade. Our relationship with CFNE has been a phenomenal success, from our point of view.”

In addition, CFNE is working with start up co-ops such as River Valley Market in Northampton, Massachusetts and Fiddleheads Co-op in New London, Connecticut to secure financing from a number of lenders to meet their borrowing needs.

Much of the money available for lending in funds such as CFNE and NCDF comes from socially motivated investments from individuals, religious institutions, foundations, and community organizations as well as banks.

But a key segment must come from cooperatives and co-op members themselves, both directly and through investments made by the Cooperative Community Funds. While investing in NCDF or CFNE might not be the most lucrative deal in town, the financial return is fair and the social return unparalleled.

Just as we encourage our members to think beyond price as the only consideration in buying food, so must we in the cooperative sector start thinking beyond yield as the only consideration in making an investment decision. If you are shopping for quality for your co-op’s savings, it’s hard to do better than your own co-op loan fund.

For if we don’t believe in building a cooperative economy with our shopping and savings dollars, who will? And if we don’t act on our beliefs, how can we expect others to? Invest in cooperation today.

***

Rebecca Dunn is executive director of Co-op Fund of New England and was a member of the recent cooperative capital task force (rdunn@cooperativefund.org). Margaret Lund was chair of the cooperative capital task force and was executive director of Northcountry Cooperative Development Fund until 2008.