Back on Our Feet

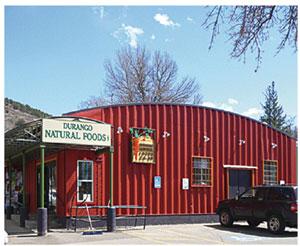

Just over a year ago, Durango Natural Foods was in trouble. Our small Colorado store was 60 days past due with our primary supplier; shelves were bare, the shopping experience was unappealing, and we were missing managers in key positions.

Getting Durango Natural Foods (DNF) back on its feet was a mixture of hard work, a great team, and simple tools that we all have at our disposal. I can’t point to one particular thing we did that made the difference, but rather to a platter full of changes that worked together with great results. The plan was uncomplicated—get food on the shelves, get customers back in the store, and get the debt paid down.

Our turnaround really started in mid-2006. In the years prior to that, DNF had faced a number of difficulties including competition in the marketplace, an expansion in response to that competition, suddenly discontinuing a 5 percent member discount without notice or education, directors without a governance process or an understanding of their role, and a poverty mentality that kept the co-op in the black but nearly budgeted the store out of business.

The co-op’s revival involved a number of people over several years. In the spring of 2006, John Mabbott came to the store for three months as the interim general manager. He worked closely with a new board of directors, and together they acquired a loan from a local bank to pay off the remainder of the co-op’s mortgage and a large number of member loans. Most important, they set aside money to create a capital improvement fund for much-needed upgrades and repairs.

Upon his exit, John left two staff members in charge. They stepped up when it was imperative to have someone in charge and did a great job of maintaining what John had started. By the time I arrived in February 2007, the store had an excellent foundation on which to build its recovery.

Road to recovery

At the beginning of 2007, we owed our distributor, United Natural Foods (UNFI), about $60k in past due invoices. Bare shelves made the shopping experience unappealing. We were missing a finance manager and a grocery manager. I assumed the grocery manager position, splitting various duties with Anna Ward, who had stepped in when John Mabbott left. We hired a bookkeeper and contracted an outside accounting service part-time. Having never been a general manager and since I already had a full plate, I enlisted the help of Mel Braverman of Cooperative Development Services, with whom I worked on a monthly basis for most of the year.

In the store, we began by fixing what the customers saw when they first walked through the door. Fortunately, the money was there from the bank loan, and we knew we could make some inexpensive changes that would make a dramatic difference. A little investigation revealed that DNF had a reputation in town as the hippie store (perhaps due to the employees with dreads and the reggae music that played most of the day) and as a store that was more expensive than the competition. We lowered prices, brought in a music service, and enforced a dress code. We contacted all the brokers in our area and asked for some deals to help us fill the shelves. Most hadn’t visited the store in years and were glad to find out we wanted to work with them. After increasing inventory, we worked on the product mix to create a pleasant and one-stop shopping experience.

Next at the top of the task list was painting the interior to get rid of dirty white walls and the store’s minimal décor. A local business supplied environmentally safe paint at a discount in exchange for thank you signs posted in the store and a few weeks of newspaper ads acknowledging their support. The owner of the paint store also contacted the manufacturers of the paint and asked them to match her discount, which they did. We bought 100 percent no-VOC paint, and a crew painted the store in two nights.

The makeover of the store interior was the transformation we were looking for, and our customers noticed. It’s simply incredible what a little spackle and paint can do, and with this renovation it was almost as if the past few years had been erased. We also began to work on modifying what customers called the “thrift store feel” by having custom produce and bulk liquid stands made (by my husband) at little or no cost. We also purchased new shelving for the wellness department. We were able to see the appreciation on the faces of our customers as they stepped in the store, and in the till when we counted out each night.

After a few months, our front-end manager, Minna Jain, was promoted to a part-time position as outreach coordinator. Minna, who had worked at Wedge Co-op years ago, revived the newsletter, which hadn’t been produced for years. In addition, Anna designed a new logo for the co-op. With my background as marketing manager from Hendersonville Food Co-op, we began focusing on branding, using our CAP (Co-op Advantage) sale signs more prominently, placing our new logo on all materials, rewriting brochures, and advertising in the local papers. As those things were implemented, we started to see things shift. After about five or six months, our sales growth really took off.

Needless to say, we hadn’t planned on 40 percent to 50 percent growth. But as customers began to respond and we saw that level of growth for weeks at a time, we finally started hiring more staff. Unfortunately, given the pace, we often could only offer training on the fly. However, our staff was enthusiastic and the store had the energy of renewal.

Challenges of growth

But growth creates its own challenges, and it began exposing problems in our overall systems. While our sales growth had become strong, our margin wasn’t always what we needed. The National Cooperative Grocers Association (NCGA) western corridor was starting to conduct in-depth store audits, and I jumped at the chance to have a group of co-op managers come help us figure out how to manage our growth and financials. The corridor supplied a crew of seven who came to Durango for two days of work.

This audit by co-op managers generated a long, prioritized list of improvements and recommendations. At first the list was daunting, but once the management team had discussed the outcome of the audit, we went to work immediately. The audit gave us some great ideas on how to get more product into our space, helped us prioritize, focused us in specific financial areas, and also reaffirmed some of what we were doing right. The recommendations and follow through came with perfect timing, and sales continued to increase.

We spent the last bit of the capital improvement fund on upgrades to our Catapult point of sale system. We also purchased the Catapult Membership Server, which allowed us to update our member records and replace incomplete electronic records and the boxes in the attic. This change meant we switched to new scan cards. Members now get a 2 percent point of sale discount, originating in an effort to entice members back to the store in 2006. However, we hope to move toward a patronage rebate structure in the future

We’ve managed to pay down our debt, with UNFI debt to just under 15 days past due, and hope to be current in the next couple of months. We also set up a savings account and started putting all our EBT/food stamp deposits into this special account. Each day’s deposit is small, but it adds up quickly and has helped us build up a small cash cushion.

Our sales growth continues: in the fourth quarter of 2007, we were up 54 percent over the previous year. Financially, we ended the year just about breaking even and with sales of $2.15 million. However, the closure of Tucson Co-op Warehouse/ShopNatural required us to write off $50,000 in equity on our balance sheet. We’re still working on some margin issues and getting the right people into the right positions.

We have a lot of turnover in part-time staff and are not yet able to pay all of our staff what they need, given the very high cost of living in the town of Durango. I’m still the grocery buyer and continue to divide duties with that department. We’re still looking for grocery and finance managers. But we have many talented and dedicated staff members; the co-op would have never made it through the last year without several of them.

Focusing on the future

After all that we accomplished last year, we can now begin to focus our energy on the future. I hope the co-op can offer medical benefits by mid-summer to full-time staff and increase pay rates across the board when we get current on the UNFI account. At some point, we’ll apply to get on the UNFI contract with National Cooperative Grocers Association as well.

We’ve come so far and have a lot of plans for Durango Natural Foods. I have to give an enormous amount of credit to the Durango community. They gave us another chance and happily came back to support the store. In truth, we could have done the same things and the community wouldn’t have had to respond, but they did. I’m certain we won’t have 50 percent sales growth in 2008, but we will have a store with a bright future.

***

Kelli Reese has been general manager at Durango Natural Foods since February 2007 (kelli@durangonaturalfoods.coop).